Last updated: December 4, 2025

Convertible Instruments

Track SAFEs and convertible notes — the equity that doesn’t exist yet but will when you raise a priced round.

Adding a Convertible

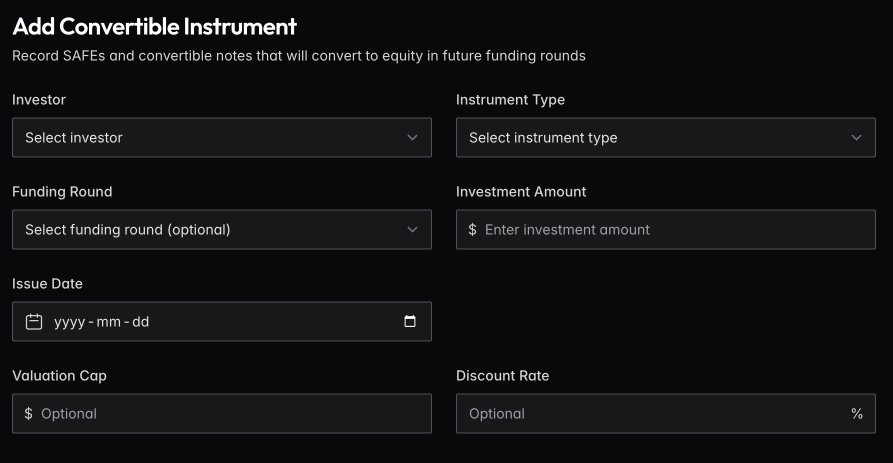

Click New Convertible Instrument (or add from a shareholder’s detail page).

Select the investor, instrument type (SAFE or Note), investment amount, and issue date. Optionally link it to a funding round.

Valuation cap sets the maximum valuation at which the instrument converts. Discount rate gives the investor a percentage off the round price. If both exist, the investor gets whichever yields more shares.

For Notes, you’ll also enter interest rate and term length.

Converting to Equity

When you close a priced round that triggers conversion, find the instrument and click Convert from the actions menu. The system calculates shares based on cap vs. discount vs. round price, creates a shareholding for the investor, and marks the instrument as converted.

Impact on Cap Table

Outstanding convertibles appear in a dedicated section of the cap table. Use the Simulator to model how they’ll affect ownership when they convert — toggle “Convert outstanding SAFEs/Notes” to see the dilution impact.